Checklist: U.S. Individual Tax Returns

Please use the below checklists to arrange the information for the preparation of U.S. personal tax returns. Starting information & Filing Status – All the individuals filing U.S. Tax returns

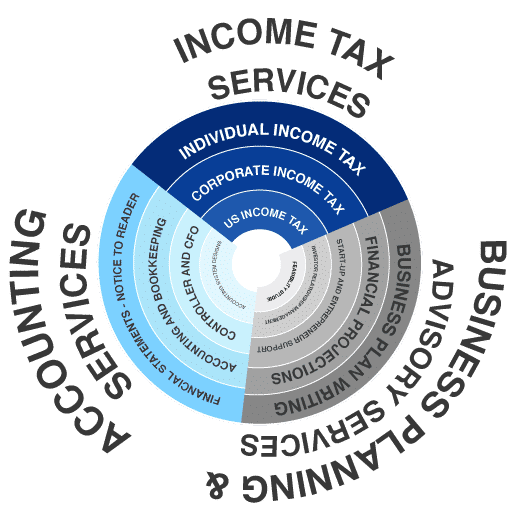

For simple to complex situations,

Individual and Corporate Income Tax Services for Canada

Cross Border (U.S.) Income Tax Services in Canada | IRS Certifying Acceptance Agent in Canada

Maroof HS CPA Professional Corporation provides comprehensive tax services for individuals and businesses in Canada. We are CRA Approved EFILER and a CPA firm registered with CPA Ontario & Alberta in Canada. We also provide Cross border tax services for the United States.

We are accepting new clients for the preparation of both Canada and U.S. Individual Income Tax Returns.

We offer tax planning and preparation services for individuals for simple to complex tax situations. Our tax preparation and filing include services for self-employed individuals, students, newcomers, non-residents; and individuals having investment income, rental income, foreign income or Non-Resident income.

We are a full-service corporate tax service provider for all sizes of businesses. We handle the complete tax compliance process for our clients from corporate tax planning to the filing of annual information returns, HST/GST returns and Income Tax returns.

We are a full-service corporate tax service provider for all sizes of businesses. We handle the complete tax compliance process for our clients from corporate tax planning to the filing of annual information returns, HST/GST returns and Income Tax returns.

We offer a full range of income tax services to Non-residents of Canada. Be it individual income tax or complicated non-resident corporate tax issues, we take of it all!

Maroof HS CPA Professional Corporation provides Individual and Corporate income tax services to individuals and businesses requiring Quebec income tax filing.

Maroof HS CPA Professional Corporation provides Certifying Acceptance Agent Services in agreement with the Internal Revenue Service of the United States. Canadians needing U.S. ITIN do not need to send the original passport to IRS.

Important disclosures: Maroof HS CPA Professional Corporation is a CPA firm registered with CPA Ontario and Alberta. In the United States or US tax Services in Canada are provided by a US Certified Public Accountant, Maroof H. Sabri.

We Look At The Profession Differently

Always perfect! Anything less than that is not acceptable..

Personalized and Well-researched insights

Please use the below checklists to arrange the information for the preparation of U.S. personal tax returns. Starting information & Filing Status – All the individuals filing U.S. Tax returns

2023 – Individual Income Tax Return (T1) Checklist Efiling Status: Canada Revenue Agency systems to allow electronic filing of Individual Income tax returns (T1) for 2023 on February 19, 2024.

Question: My corporation, a CCPC, has a catering business and holds a building as an asset. I rent a portion of the building but use the rest in my operations. Is my corporation now Specified Investment Business?

Question: Do Canadian Corps using U.S. Amazon FBA services need to pay branch profit taxes and file 5472.