Voluntary Disclosure Program in Canada

The Voluntary Disclosures Program (VDP), administered by the Canada Revenue Agency (CRA), is one of the most important compliance tools in Canada’s tax system.

VDP gives taxpayers a structured pathway to correct past tax errors, unreported income, missed filings, or omissions involving GST/HST, payroll, or even foreign assets. Instead of facing the full weight of penalties, compounding interest, or criminal prosecution, taxpayers who make a valid disclosure can bring their affairs back into compliance while benefiting from penalty relief and partial interest forgiveness.

The policy foundation of the VDP is simple: it is better for both taxpayers and the CRA if mistakes are corrected voluntarily, quickly, and transparently, rather than discovered through costly enforcement measures.

Fairness and Policy Balance

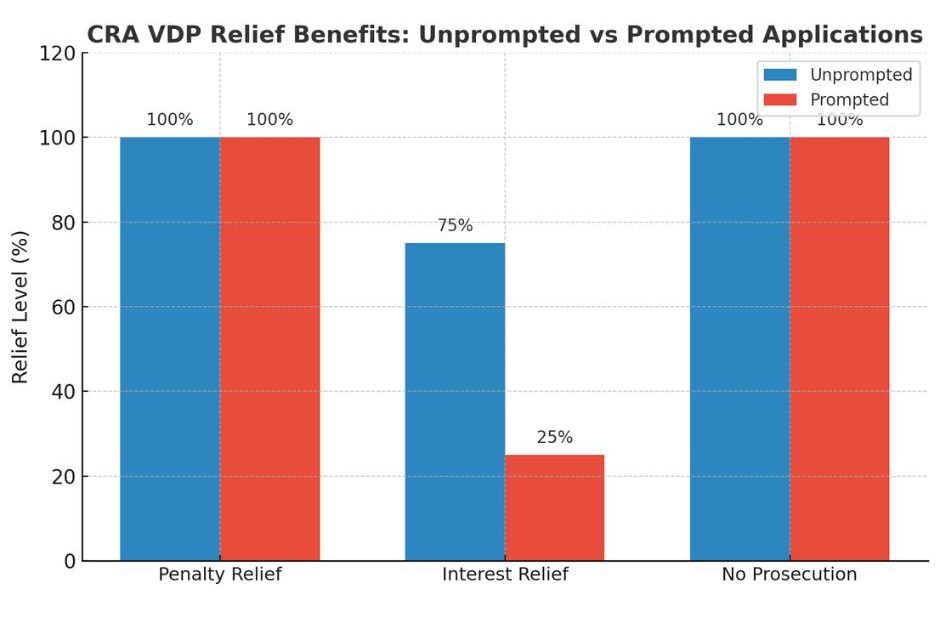

From a policy perspective, the VDP balances two competing interests: fairness to taxpayers who always comply, and flexibility for those who come forward to fix mistakes. The CRA has consistently emphasized that compliant taxpayers should not be disadvantaged, which is why relief under the program is structured differently depending on timing. Taxpayers who apply before the CRA has initiated contact generally receive full penalty relief and up to 75% interest relief. Those who apply after being prompted by the CRA (more to be discussed further) receive only partial relief, reflecting the fact that they disclosed after detection was likely. This tiered system ensures fairness and reinforces the broader policy goal that compliance should be proactive, not reactive.

Broader Administrative Objectives

The VDP also reflects broader objectives in Canadian tax administration. By lowering the barriers to disclosure, the CRA reduces its reliance on audits and investigations, freeing resources to focus on deliberate tax evasion and complex avoidance schemes. At the same time, the program strengthens public trust in the system by demonstrating that tax enforcement is firm but also pragmatic. Canadians can see that while the CRA holds taxpayers accountable, it also recognizes honest mistakes and provides a second chance. In this way, the VDP supports compliance, efficiency, and confidence in Canada’s tax policy framework.

Historical Development of the VDP

The history of the Voluntary Disclosures Program (VDP) reflects both evolving tax policy priorities and the CRA’s effort to balance fairness with compliance.

The first formal framework was introduced in 2000 with Information Circular IC00-1, which set out the initial rules for voluntary disclosures under the discretionary relief authority in subsection 220(3.1) of the Income Tax Act. Over the following years, several revisions—culminating in IC00-1R5 in 2014—clarified eligibility requirements and strengthened the program’s structure.

Major changes came in 2018 with IC00-1R6, which introduced separate program streams and narrowed relief in cases involving intentional non-compliance, reflecting growing concerns about fairness for compliant taxpayers.

October 1, 2025 – IC00-1R7 Update

Most recently, IC00-1R7, effective October 1, 2025, has updated the framework once again by simplifying application rules. It refined the ‘determination of voluntary’ for VDP purposes by distinguishing between unpromoted and prompted disclosures. It further extends the coverage to newer taxes such as the Underused Housing Tax (UHT) and the Digital Services Tax. Though UHT is included in this new package of changes, however, we have successfully obtained the relief for Underused housing tax returns before October 1, 2025, as well.

Together, these milestones show how the VDP has evolved into a more structured, transparent, and policy-driven program that adapts to modern compliance challenges while continuing to promote voluntary correction of past errors.

Types of Relief under VDP

If the CRA accepts a Voluntary Disclosures Program (VDP) application, taxpayers may receive up to three key benefits:

-

Penalty Relief – late-filing penalties, gross negligence penalties, and other related charges may be waived in full.

-

Interest Relief – a portion of arrears interest may be cancelled, depending on whether the disclosure was voluntary or prompted.

-

No Criminal Prosecution – the taxpayer will not be referred for criminal investigation or prosecution for the issues disclosed.

The exact amount of relief depends on the timing and circumstances of the disclosure. The CRA distinguishes between unprompted applications (where the taxpayer comes forward before any CRA enforcement contact) and prompted applications (where disclosure occurs after the CRA has raised concerns or obtained third-party information).

Unprompted applications are generally eligible for general relief, which provides:

-

100% relief of applicable penalties, and

-

75% relief of applicable interest.

Prompted applications are generally eligible for partial relief, which provides:

-

Up to 100% relief of applicable penalties, and

-

25% relief of applicable interest.

In both cases, protection from prosecution is guaranteed if the application is accepted, and gross negligence penalties will not apply. Relief is also subject to the limitation period under subsection 220(3.1) of the Income Tax Act, which restricts how far back the CRA may cancel penalties or interest.

Previously, the VDP operated under a General Program and a Limited Program, with relief varying based on the seriousness of non-compliance. As of October 1, 2025, this has been replaced with the Unprompted vs. Prompted framework, making the rules simpler and more transparent.

Maroof HS CPA Professional Corporation has saved both individual and corporate taxpayers millions of dollars in penalties and interest using the Voluntary Disclosure Program.

Eligibility & The Process

Eligibility Conditions for VDP

The eligibility conditions remain largely the same as those of the prior program, with some minor adjustments. These changes now make the VDP process simplified and easier to understand.

To qualify for relief under the CRA’s Voluntary Disclosures Program, an application must meet all of the following conditions:

- Voluntary disclosure – The application must be filed before the CRA contacts the taxpayer about the error or omission. This is the most important aspect of the relief, more on this below.

- Complete disclosure – The taxpayer must fully disclose all errors, omissions, or non-compliance for the relevant years. This is where most DIY filers make mistakes.

- Past due information – The disclosure must relate to a return, form, or reporting obligation that is at least one year past its due date. For example, if 2023 T1134 was originally due on October 31st of 2024, it can be eligible for the VDP after October 31st of 2025.

- Tax at risk – There must be potential taxes, penalties, or interest owing; disclosures that only result in refunds are not eligible. If you are filing for multiple tax years, where the tax returns have refunds and the missing information returns, such as T1135 or T1134, are subject to penalties. Relief is only applicable to the information returns with the penalty.

- Supporting documentation – Amended returns, schedules, statements, or other records must be included to support the correction. This typically includes amended returns, schedules, financial statements, and transaction records. For domestic issues, at least the last six years must be covered, while disclosures involving foreign income or assets require up to ten years of documentation.

- Payment or payment arrangement – A payment for the estimated taxes owing, or a request for a payment arrangement, must accompany the application.

If the VDP application does not meet the above conditions, the applicant runs the risk of a disclosure without any relief.

What is considered Voluntary?

Under the prior version of the program (IC00-1R6), the CRA divided applications into a General Program and a Limited Program, with relief depending on how serious the non-compliance appeared. With the release of IC00-1R7 (effective October 1, 2025), this structure has been replaced with a simpler and clearer distinction between unprompted and prompted applications.

A key condition of the Voluntary Disclosures Program (VDP) is that the application must be voluntary. This means the taxpayer comes forward to correct their errors or omissions before the Canada Revenue Agency (CRA) initiates compliance action. If the CRA has already started an audit, investigation, or has received third-party information linking the taxpayer to non-compliance, the disclosure will not be considered voluntary.

Effective October 1, 2025, within this framework, the CRA distinguishes between two types of voluntary applications:

Unprompted applications

Filed before the CRA has contacted the taxpayer about the issue. These are eligible for the highest level of relief, including 100% relief from penalties and up to 75% relief of interest. For example, a taxpayer who realizes they failed to report foreign investment income and applies before the CRA requests information would be considered unprompted.

Prompted applications

Filed after the CRA has signalled potential non-compliance, such as sending a notice identifying an error, requesting corrections, or receiving third-party data (for example, from banks or tax authorities). Prompted applications are still considered voluntary because the taxpayer makes the disclosure rather than waiting for enforcement to escalate, but the relief is more limited: up to 100% penalty relief and only 25% relief of interest.

This two-tiered approach replaces the older General/Limited structure with a model that is easier to apply and more transparent. Taxpayers who proactively disclose benefit from significantly greater relief, while those who act after being prompted by the CRA still avoid gross negligence penalties and criminal prosecution but face reduced interest relief.

When can you apply for VDP?

A taxpayer can apply to the Voluntary Disclosures Program when they recognize past errors, omissions, or non-compliance that may otherwise result in penalties, interest, or prosecution.

Under IC00-1R7, eligible situations include:

- Unreported income, such as rental income, self-employment income, investment income, or foreign earnings.

- Forms on the Tax returns that can cause penalties, such as T1161 on an emigrant tax return.

- Missing information returns, such as T1134 (Foreign Affiliate Reporting) or T1135 (Foreign Income Verification).

- Underused Housing tax returns – UHT-2900

- Incorrect GST/HST or payroll filings – underreported sales, miscalculated remittances, or missed payroll source deductions.

- Improper expense claims – deductions that were overstated or not fully supported.

Under the older IC00-1R6 framework, CRA often accepted disclosures from small businesses that failed to register for GST/HST on time or from taxpayers who incorrectly claimed personal expenses through their corporation. These remain eligible under IC00-1R7, provided the disclosure is voluntary, complete, and past due.

Even though UHT-2900 has been recently added by the CRA, however, we have successfully obtained the VDP relief for under-used housing tax returns. A group of nonresident investors reached out to us for UHT-2900 filings. There were penalties involved due to the late filings on the very first filing season. We explained the options, and they decided to wait as soon as they are eligible for VDP. By filing 365 days after the original due date saved themselves the penalties.

When You Cannot Apply

The VDP does not apply in every situation. IC00-1R7 clarifies that applications will be denied if:

- The disclosure only results in a refund or has no taxes, penalties, or interest owing.

- The taxpayer seeks relief from penalties and interest already assessed.

- The disclosure attempts to make or change a tax election.

- The tax years involved are covered by an insolvency proceeding.

- The issue is covered by an Advance Pricing Arrangement (APA) or depends on a tax treaty negotiation.

- The CRA has already received third-party information about the non-compliance.

An audit or investigation has begun, whether by the CRA or another authority.

Under IC00-1R6, taxpayers involved in aggressive tax planning or intentional conduct were not excluded, but their applications were processed under the Limited Program, where relief was narrower. With IC00-1R7, this distinction has been eliminated, but disclosures that appear to be structured attempts to game the system may still face close scrutiny from the CRA.

One of the reasons for our outstanding success rate with CRA Voluntary Disclosure programs is that we ensure the applications meet the eligibility criteria. For the situations where the criteria are not met, there might be other options, though less attractive.

CRA decisions and Appeals

What happens when a VDP application is denied by the CRA?

VDP relief is a matter of ministerial discretion under subsection 220(3.1) of the Income Tax Act. If the Canada Revenue Agency (CRA) denies or limits relief under the Voluntary Disclosures Program (VDP), taxpayers do not have a traditional right of objection.

However, the CRA provides a two-step review process.

First, taxpayers may request a second administrative review, handled by a senior official at the Shawinigan National Verification and Collections Centre, who was not involved in the original decision. If the taxpayer still believes the CRA acted unfairly or unreasonably, the decision can then be challenged through a judicial review application at the Federal Court under section 18.1 of the Federal Courts Act.

Judicial review does not reconsider the facts but examines whether the CRA properly exercised its discretion. While there is no formal appeal route, these review options give taxpayers a path to seek reconsideration and ensure that VDP decisions are made in good faith and in line with principles of fairness.

How can we help?

Many VDP applications fail because of incomplete disclosure. Others are rejected due to missing documents or mistakes in eligibility rules. Even a small error, such as leaving out one year of non-compliance, can lead the CRA to deny relief completely. The process is technical and often covers multiple tax years. The consequences of filing incorrectly can be severe, with large penalties and interest at stake, or even a prosecution. This is why it is so important to work with a professional tax accountant who has experience with VDP applications.

An experienced tax advisor ensures that your application is accurate, complete, and has a higher chance of acceptance.

At Maroof HS CPA Professional Corporation, we have assisted taxpayers through the VDP for many years. Our experience ranges from simple cases, such as late-filed slips or minor errors, to highly complex tax situations involving multiple years of unreported income, GST/HST, payroll, or information returns. We understand the details of how the CRA evaluates VDP applications, and we know how to present your case in a way that maximizes relief. Above all, we can assist you with the preparation of some of the most complex areas in income tax law in Canada, such as cross-border or International transactions, foreign accrual property income, and tiered corporate structures.

Our success rate with VDP applications is excellent, and we are proud to be recognized in the industry for the results we achieve. We have helped many clients come forward voluntarily, resolve their past non-compliance, and move forward with peace of mind. Not to mention the millions of dollars we helped save in penalties and interest.

If you are considering the Voluntary Disclosures Program, contact us today. Let our proven track record and expertise help you secure the relief you need.