Important Deadlines – 2023 Tax returns

Important Deadlines: 2023 Tax Returns to be filed in 2024 As the 2024 tax season approaches, taxpayers in both Canada and the United States must follow critical deadlines to ensure

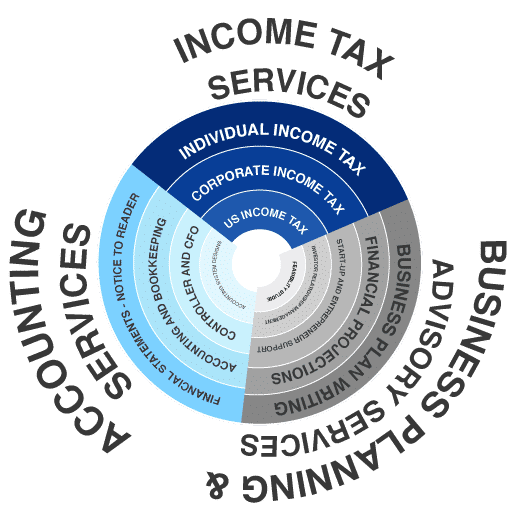

For simple to complex situations,

Individual and Corporate Income Tax Services for Canada

Cross Border (U.S.) Income Tax Services in Canada | IRS Certifying Acceptance Agent in Canada

Maroof HS CPA Professional Corporation provides comprehensive tax services for individuals and businesses in Canada. We are CRA Approved EFILER and a CPA firm registered with CPA Ontario & Alberta in Canada. We also provide Cross border tax services for the United States.

We are accepting new clients for the preparation of both Canada and U.S. Individual Income Tax Returns.

We offer tax planning and preparation services for individuals for simple to complex tax situations. Our tax preparation and filing include services for self-employed individuals, students, newcomers, non-residents; and individuals having investment income, rental income, foreign income or Non-Resident income.

We are a full-service corporate tax service provider for all sizes of businesses. We handle the complete tax compliance process for our clients from corporate tax planning to the filing of annual information returns, HST/GST returns and Income Tax returns.

We are a full-service corporate tax service provider for all sizes of businesses. We handle the complete tax compliance process for our clients from corporate tax planning to the filing of annual information returns, HST/GST returns and Income Tax returns.

We offer a full range of income tax services to Non-residents of Canada. Be it individual income tax or complicated non-resident corporate tax issues, we take of it all!

Maroof HS CPA Professional Corporation provides Individual and Corporate income tax services to individuals and businesses requiring Quebec income tax filing.

Maroof HS CPA Professional Corporation provides Certifying Acceptance Agent Services in agreement with the Internal Revenue Service of the United States. Canadians needing U.S. ITIN do not need to send the original passport to IRS.

Important disclosures: Maroof HS CPA Professional Corporation is a CPA firm registered with CPA Ontario and Alberta. In the United States or US tax Services in Canada are provided by a US Certified Public Accountant, Maroof H. Sabri.

We Look At The Profession Differently

Always perfect! Anything less than that is not acceptable..

Personalized and Well-researched insights

Important Deadlines: 2023 Tax Returns to be filed in 2024 As the 2024 tax season approaches, taxpayers in both Canada and the United States must follow critical deadlines to ensure

Please use the below checklists to arrange for your information if you are filing Section 216 tax returns and non-resident individual income tax returns in Canada. Individual Tax Number (ITN)

Question asked by Sumit Khanna My son owns a house where he lives. He was having a hard time getting a mortgage. I decided to be on the title of

Tax Question asked by Aiman Doe (Name changed at their request) I am an American living in Canada since 2011. I own a Canadian Corporation since 2012. I have never

Question: Can a U.S. LLC claim exemption from Canadian corporate income tax under article VII of treaty if it has non-us members?

Question: I Am An IT Professional. I Just Received An Offer From My Employer. My Employer Wants Me To Incorporate And They Have Agreed To Offer A Better Hourly Rate. I Am Confused Should I Set Up A Corporation Or Become An Employee?

Question: My mother passed away in India last month. I am receiving my share of the family house. The home is located in India. I am a resident of Canada. Do I need to pay taxes in Canada when this property is transferred to me?