2020 Tax season just started.

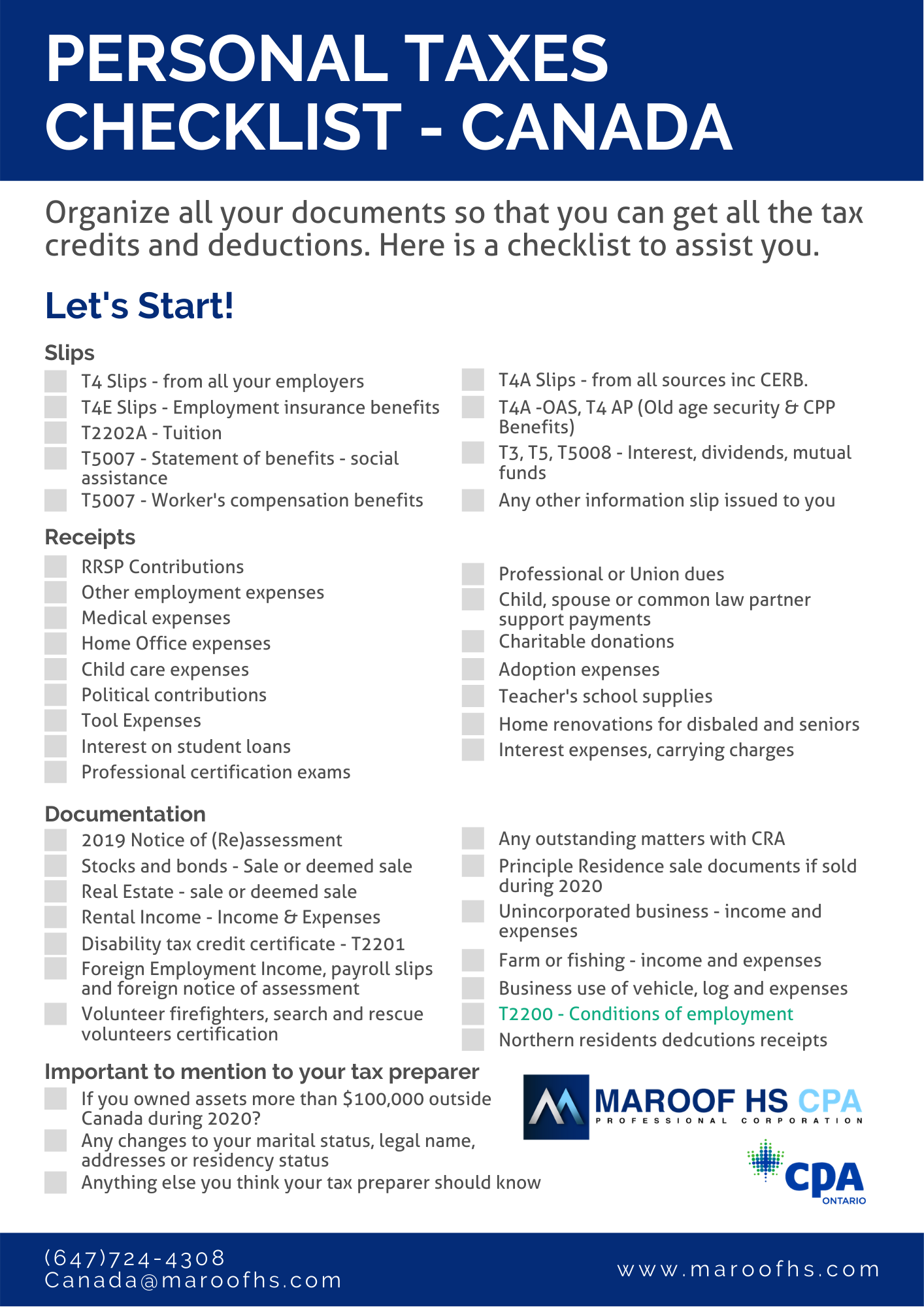

Individual income tax and benefits returns are now open for e-filing. A checklist is compiled to help you preparing all the documents for your tax appointment.

Please do not forget to ask your employer T2200 or T2200s in order to claim work from home expenses for 2020. CRA has issued T4As for different covid-19 related assistance payments.

If you are running an unincorporated business such as a sole proprietorship, please note that forgivable portion of CEBA loan needs to be included in the income.

We recommend to wait until March 02, 2021 before processing your 2020 tax returns unless all the slips are received before that.

Maroof HS CPA Professional Corporation is a CPA firm located in Vaughan Ontario. We provide a full scale Individual Income Tax Services, Corporate Income Tax Services in Canada and Cross border Income Tax Services for the U.S.