Global Intangible Low-Taxed Income – Simplified!

The Tax Cuts and Jobs Act of 2017 (TCJA) brought major changes to the U.S. tax system. With these changes come additional complications for U.S. citizens and resident aliens.

The Global Intangible Low-Taxed Income (GILTI) regime was enacted to tax the U.S. Shareholders of Controlled Foreign Corporations (CFC) on a current basis. TCJA introduced the Transition tax and GILTI. Transition tax (Sec 965) is a one-time tax on the post-1986 undistributed earnings of CFCs of individual US shareholders. Whereas GILTI is applicable on an ongoing basis, as required by Sec 951A.

2020 Update: In July 2020, the treasury issued final regulations TD 9902 and proposed regulations REG-127732-19

Final regulations provide some relief in the form of High-Tax Exclusion (HTE) whereas the proposed regulations address the High-Tax Exception from subpart F income.

Notice to Readers: This post is to simplify the GILTI and its implications for US taxpayers with Canadian CFCs. Further updates might be needed for future changes, therefore, please always refer to the date of this article. This article is not a professional advice and the readers should consult their cross-border tax accountants before making any decisions.

What is GILTI?

GILTI stands for Global Intangible Low-Taxed Income. IRC Section 951A deals with GILTI, so, when different schedules or tax forms mention 951A income, that is GILTI.

Do not confuse GILTI with the word Intangible in its name! The scope of GILTI extends way beyond the one indicated by its name. GILTI is a CFC’s (Controlled foreign corporation) income after subpart F income, added to the US shareholder’s current income regardless of whether the income is distributed in the given year or not. Subpart F income continues to be taxed on the current basis before Sec 951A income, i.e. first subpart F income is added and then Sec 951A. GILTI is a part of Subpart F of the Internal Revenue Code, however, the calculation for GILTI is entirely different.

The U.S. shareholders of CFCs need to include GILTI income for the corporation tax years beginning after December 31, 2017. Bear in mind, if the same corporation was existing in 2017, transition tax rules under Sec 965 also apply for that year.

Who is subject to GILTI?

US shareholders who own at least 10% of a Controlled Foreign Corporation (CFC). This ownership of a CFC can be direct, indirect, or Constructive, either 10% of the combined voting power of all classes of shares or 10% of the value of all classes of the shares.

A controlled foreign corporation is a foreign corporation meeting two conditions:

- More than 50% of the foreign corporation’s stocks, either vote or in value, are owned by U.S. persons.

- If the U.S. shareholder of such a corporation (as mentioned above) owns at least 10% of votes or value, it is considered a CFC.

U.S. shareholders can be either individuals or corporate. However, different tax rates are applicable for GILTI for individual and corporate taxpayers.

For U.S. citizens, it does not matter wherever they live in the world but U.S. Green cardholders who do not tie-break to Canada under the treaty are subject to Sec 951A income inclusion as well. When a Canadian tax resident moves to the U.S. and becomes a U.S. tax resident, she is also subject to the same set of rules. Sometimes the U.S. spouses elect to treat non-U.S. spouses as U.S. resident aliens for tax purposes subject them to U.S. tax rules including Sec 951A.

IRS form 5471, now, includes a schedule I-1 to report CFC-level amounts used in GILTI calculation.

Does 951A apply to your situation?

| Are you a U.S. resident alien for tax purposes? | |

| Yes, | No > Sec 951A not applicable |

| Do you own directly, indirectly, or constructively shares of a Canadian Corporation? | |

| Yes | No > Sec 951A not applicable* |

| Is this corporation a controlled foreign corporation? | |

| yes | No > Sec 951A not applicable* |

| Are you a U.S. shareholder? (10 percent or more) | |

| Yes | No > Sec 951A not applicable* |

| Section 951 A applies to you | PFIC rules may apply* |

GILTI and the Canadian Corporations

Many U.S. citizens living in Canada, including dual citizens, own Canadian corporations.

How does GILTI impact these shareholders?

It depends largely on the type of corporation and investments. However, two important types of corporations are mostly affected:

- Canadian Controlled Private Corporations: Canadian-controlled private corporations (CCPC) generally enjoy lower corporate income tax rates in Canada due to small business deductions (SBD). SBD brings down the effective tax rate as it is applied as a credit to the tax liability of a CCPC. Though there is no requirement for a corporate taxpayer to use SBD, however, a taxpayer cannot voluntarily refuse to take this credit in order to avoid the GILTI application.

- Professional Corporations or Services corporations: Another type of corporation most affected by GILTI is the corporations in the services industry with lower tangible assets. Most professional corporations such as accounting firms and law firms do not own much of tangible assets. The U.S. shareholders of such corporations generally see an impact of GILTI and incremental U.S. taxes.

This is also possible that U.S. resident aliens, including green cardholders, also own the shares of Canadian-Controlled Private Corporations (CCPC). The U.S. tax code applies certain attribution rules to classify a foreign corporation as a CFC. There is a different set of rules that are applicable to Canadian corporations to determine the control for them to be classified as CCPCs.

For example, a U.S. green cardholder who did not tie-break to Canada owns 15% of the common stock of a Canadian corporation. Another Dual-Citizen owns 40% and the remaining 45% is owned by Canadian tax residents. The Canadian corporation will become a CFC for U.S. tax purposes and a CCPC for Canadian tax purposes.

How is GILTI Calculated?

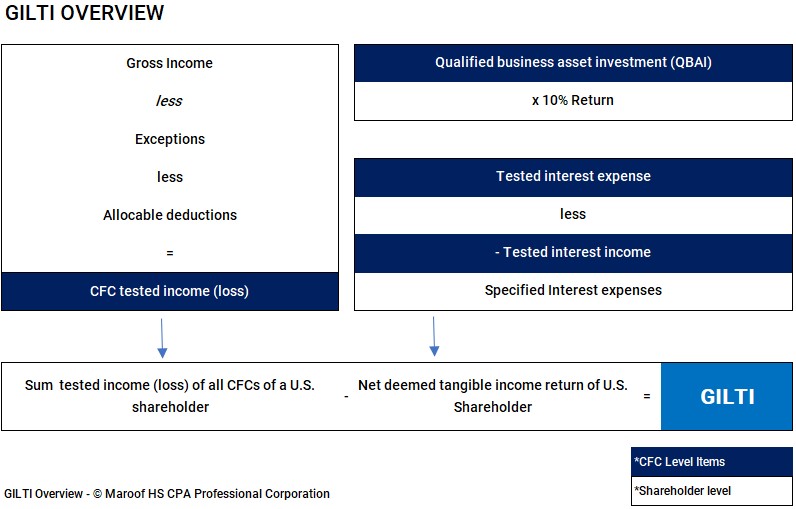

GILTI is calculated using the below formula:

GILTI = Net CFC tested income – net deemed intangible income return

Where,

Net CFC tested income = aggregate pro-rata share of tested income of each CFC – pro-rata share of each CFC’s tested loss

Net deemed tangible income return (DTIR) = 10% of pro-rata share of qualified business asset investment (QBAI)

CFC tested income

In essence, CFC-tested income is the gross income less deductions and Subpart F Income.

While calculating the CFC’s tested income, certain income is excluded from the calculation:

- Branch income for which CFC files 1120-F (ECI of CFC)

- Sec 951(a)(1) Subpart F income

- Income excluded from Subpart F income under the high-tax exception, Sec 954(b)(4)

- Sec 954 (b)(5) dividends received from related persons

- foreign income from oil & gas extraction

How to calculate the pro-rata share of the CFC’s income by the US shareholders? The pro-rata share should be commensurate with the relative economic interest of the shareholder. For example, the income allocation to a preferred shareholder is different than the one to the common shareholder. While making this allocation, one should assume if there is an actual distribution, how much the shareholder will get.

How about allocating the deductions to the excluded income of CFC? By treating the CFC as a domestic corporation and determining the deductions as per section 61.

Deemed intangible income return (DITR)

Deemed intangible income return is a “routine” return on tangible assets. Routine return, in this case, is set to be at 10%. So the CFC’s tangible assets, qualified business asset investment (QBAI) are assumed to generate a 10% return annually.

- CFC’s tangible assets are recalculated using US Alternative depreciation system (ADS) rules every quarter.

- Net DTIR is used to offset the Net tested income of the U.S. shareholders.

- QBAI of a tested loss CFC is excluded from the calculation of aggregate pro-rata share of QBAI.

- QBAI in excess of 10X of tested income is allocated to the common shareholders.

- Temporarily held, more than one quarter and less than 12 months, tangibles are ignored for GILTI calculation as per anti-abuse provisions.

This is important for the shareholders to plan ahead to best optimize the GILTI inclusions. For example,

- Merge loss-making CFC with profit-making one since the tested loss CFCs are excluded from aggregate pro-rata share of QBAI calculation.

- Even if the assets placed before tax reform are fully depreciated, using ADS may result in a QBAI base.

- Be mindful of the new acquisitions and plan carefully so that the assets are not excluded under anti-abuse rules.

GILTI high-tax exclusion

GILTI high-tax exclusion (HTE), similar to the high-tax exception under subpart F, was added to the final regulations issued in July 2020.

- HTE election is available for the corporation’s tax year beginning after July 23, 2020. However, the election can be applied for the tax years beginning after December 31, 2017, and the taxpayers can amend the already filed affected the tax returns.

- The election is made by the Controlling domestic shareholder. The shareholder making this election must give notice to all other affected shareholders who do not have an option to elect otherwise. The election is made for the whole group of CFCs and the controlling shareholder cannot pick and choose the individual CFCs.

- GILTI is calculated using “net” CFC-tested income. By electing HTE, it is possible that a loss CFC (U.S. loss, not foreign loss) may become an excluded one. The excluded CFC cannot reduce net CFC tested income anymore, hence, the loss is not included for the GILTI calculation.

- HTE also excludes the tangible assets (QBAI) of excluded CFCs. This may increase the net CFC-tested income and create U.S. tax liability

- HTE can adversely affect foreign tax credits! All the low-taxed CFCs can result in lower foreign tax credits.

- HTE is available on a year-by-year basis.

- Low-taxed income will keep on giving rise to GILTI

Effective Foreign tax rate for high-tax exclusion

The final regulations use the “tested unit” concept as opposed to the previously proposed “qualified business unit”. The effective tax rate is determined at the tested-unit level instead of the overall effective foreign tax rate of the CFC.

Tested units are a further breakdown of a CFC and can be a CFC, a flow-through entity, or a branch of a CFC. The foreign effective tax rate at each tested unit level helps the taxpayer if one tested unit pays a higher tax then than another one.

GILTI high-tax exclusion of the CFC income is only available if the foreign effective tax rate is more than 90% of the maximum U.S. statutory corporate income tax rate. The current U.S. corporate income tax rate is 21%, therefore, the effective foreign tax return of a tested unit must be greater than 18.9%. The income used to calculate the effective income tax rate is calculated using U.S. principles.

Many of the CCPCs have an effective income tax rate lower than this. However, the non-CCPCs (OPCs or CCPCs with higher income) may qualify for high-tax exclusion due to higher corporate tax rates in Canada than in the U.S.

How the GILTI is taxed?

GILTI is included in the taxpayer’s income for the year. The tax rate depends on whether the taxpayer is an individual or a corporation.

- There is a disparity between individual and corporate taxpayers. GILTI is taxed at the marginal rates for individual taxpayers which may go up all the way up to 37% (2020 – highest tax bracket rate). Since corporate taxpayers enjoy a 50% deduction of GILTI income (sec 250), the resulting tax rate is 10.5% (ignoring the effects of distributions).

- Section 962 election is available for the individual shareholders to be taxed as a corporation.

- Income due to GILTI inclusion is taxed only once! The future distribution of dividends from the CFC is not taxable to the shareholders.

- Net tested loss of one year is not available for carrying forward to the next years.

- Different tax years of CFC and shareholders may result in foreign tax credit mismatch.

Section 962 Election

Foreign tax credits (FTC) are an important mechanism to avoid double taxation.

Section 960 of IRC allows U.S. domestic “C” corps to claim the foreign tax credit on both Subpart F and GILTI inclusion from CFCs. If the individual taxpayers elect under Section 962 to be taxed as domestic C corps, they are entitled to indirect foreign tax credit similar to Sec 960, subject to Statutory limits. This mechanism is further explained in Regulations 1.962-2.

Section 962 election for individual taxpayers

Reg. 1.962-2 provides the mechanism for an individual taxpayer to be taxed as a corporation using Sec 962 election. Individuals who are partners in U.S. partnerships or shareholders in U.S. S corporations can also make this election, at an individual level instead of a partnership or S Corp level.

- GILTI income is taxed at the corporate tax rate (21%) instead of personal margin rates (37% highest).

- Electing individuals can also benefit from Sec 250 deduction against the GILTI income inclusion. Sec 250 deduction can reduce the GILTI inclusion up to 50%!

- Taxpayers can use foreign taxes paid up to 80% to reduce GILTI tax liability.

- Individual taxpayers are subject to tax on qualified dividends (15%) when the actual distributions from CFC take place. However, foreign tax credits are also available for the foreign tax paid on dividends. Dividends from Canadian corporations to U.S. residents are subject to reduced taxes due to the treaty.

- The amount of dividends received is reduced by any U.S. taxes paid on income inclusion (both Subpart F and GILTI).

Section 962 requires a careful analysis! On the surface, it may look like an attractive option that may not live up to the expectation.

Future of GILTI under Biden’s tax plan

President Biden has vowed to increase the corporate tax rates to 28% and remove the 50% deduction of GILTI income for corporate taxpayers. Moreover, at individual levels, Biden’s tax plan intends to revert the highest income tax rate to 39.6% (currently 37%).

- A corporate tax rate increase can raise the threshold for the high-tax exclusion. The current threshold is 18.9% at a 21% current US corporate tax rate, an increase to 28% will result in a 25.2% threshold of HTE. This can cause more CCPCs to be not eligible to take advantage of HTE.

- Removal of the 50% deduction on GILTI income inclusion will make US corporate shareholders revisit their tax planning.

- Personal tax rates increase can result in higher tax liability on GILTI income.

How to avoid GILTI inclusion?

GILTI inclusion is not an option, it’s a requirement! If US persons own the Canadian corporations (or other controlled foreign corporations in other countries) they are subject to GILTI rules. GILTI calculations and tax preparation costs sometimes run high for small businesses. There are a couple of ways where US shareholders of Canadian corporations can optimize their income taxes:

Pay yourself a Salary:

If you work for your professional corporation or run a services business through a corporation, pay yourself a salary. By doing so you can avoid filing elections.

Many owner-managers in Canada tend to not pay themselves salaries. However, paying yourself a salary from your corporation can result in a deduction reducing the corporate taxable income. This can be particularly helpful if the business is a small business. Employment income taxed on T1 generally generates enough foreign tax credit to wipe off income taxes on wages on 1040.

Use section 962 election:

File Sec 962 election so that the income is not taxed at the higher personal marginal rates in the U.S. This way foreign tax credits can be utilized at both personal and corporate levels. For more details, see above.

Other Options

- Merge Loss-making tested units with profit-making ones.

- If you are a small business, consider operating in an unincorporated form of business such as a sole proprietorship.

- Restructure your Canadian corporation as a subsidiary of US C corp.

Using Debt to Avoid GILTI Inclusion

Watch for the re-characterization of debt as equity

Sometimes, some advisers or accountants suggest loaning funds to foreign corporations instead of equity. If there is a loan instead of equity, the foreign corporation (for example Canadian corporation of a U.S. shareholder) is not a CFC, hence, no GILTI exclusion.

Well, one must be careful in doing so!

IRS can re-characterize a debt instrument as an equity one. If it does re-characterize, the taxpayer is not looking at GILTI or another subpart F income inclusion, but also potential hefty penalties on missed 5471 filings as well. More information on debt vs equity can be found in IRC Section 385.

Final Word

GILTI and related elections are complex tax issues and taxpayers must plan ahead with their cross-border tax accountants. U.S. Canada Cross border tax professionals are generally up-to-date with the changing income tax rules and treaty matters.

Maroof HS CPA Professional Corporation is a Toronto accounting firm offering full-scale cross-border income tax services in Canada. Get in touch with us!

4 thoughts on “Understanding GILTI – For US Expats in Canada”

Do you help with Sec 962? I am struggling. Help.

Yes, we do. You can drop an email to Canada@MaroofHS.com and my colleague will take care of scheduling.

Hi Maroof,

Thanks for informative article on GILITI.

if individual taxpayer select Sec 962 election. (Not sec 250 deduction as he has no US corporation). The

Dividend he receives from his Canadian CCPC (CFC) as share holder of his CCPC is qualified dividend (subject to long-term capital gain tax) in his IRS return. is it correct understanding ?

Hi David, there might a be slight confusion here. An individual making section 962 election does not need to have a U.S. corporation, the purpose of the election itself is to have the same treatment as U.S. corporation (more or less, though there are still differences).