Filing requirements: Non-residents with Rental income from Canada

Non-residents of Canada who own Canadian real properties and generate rental income from such properties need to comply with certain reporting requirements.

Important Disclaimer:

Please note that this post, or any other post on this website, is for general information and discussion purposes. Readers must exercise extreme caution while making decisions solely based on this information. Nonresident rules can become quite complex even with the minor changes of facts, therefore, seeking an advice from a reputable international tax expert can ensure proper compliance.

In this post, we are trying to simplify filing requirements for the non-residents of Canada having rental income. This article/post outlines the compliance with Canada Revenue Agency’s (CRA) reporting requirements only. It does not deal with other local regulations imposed by the municipalities or other jurisdictions such as property taxes, vacant home taxes as imposed by cities, or land transfer taxes etc.

Reporting Requirements in Nutshell

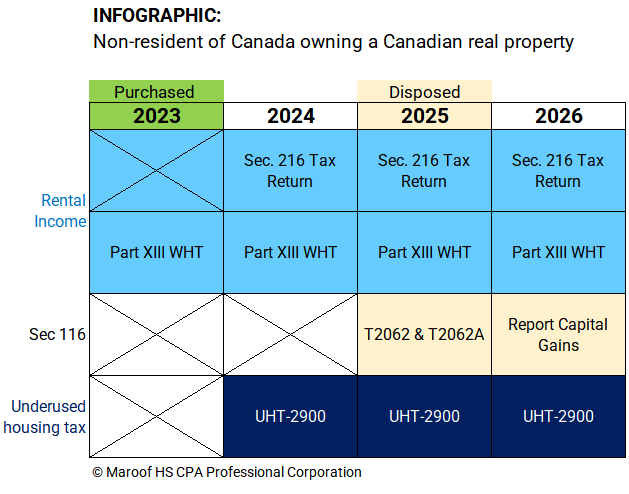

Non-residents of Canada having rental properties in Canada are generally subject to the below set of rules:

(Please read the disclaimer mentioned above).

- Income taxes on rental income – Section 216 and/or Part XIII tax

- Certificate of compliance requirements at the time of disposition

- Underused housing tax

Rental Income

Rental income paid to a Non-Resident (NR) of Canada is subject to Part XIII withholding requirements. The payor must withhold the taxes on the gross income. This withholding is the final liability and no Canadian tax return is required. Given that no deductions are made, a section 216 tax return allows a non resident to claim deductions. If the NR taxpayer wants, form NR6 can help with a lower withholding rate, however, it requires the CRA’s approval. If CRA approves NR6, a section 216 tax return must be filed by June 30th of the next year.

Read in detail about Section 216 tax return for non-residents of Canada

Disposition or Sale of Property

A non-resident must file a request for the certificate of compliance when she disposes of a property in Canada. In case of rental property, form T2062A is applicable in addition to form T2062. A non-resident must file this request within 10 days of the disposition of property. (Bear in mind, at time of purchase of the same property, Sec 116 withholding requirement might be applicable if the seller was a Non-Resident.)

Underused Housing Tax

This is a relatively new set of rules effective tax years starting from 2022. First ever UHT returns (UHT-2900) are due in 2023. Due to the confusions around new rules, CRA extended the deadline to October 31st of 2023. Normal deadline is April 30th. Read more about underused housing tax in Canada.

How can we help you?

If you are a non-resident with the filing requirements of section 216 tax returns, underused housing tax returns or certificate of compliance, we can help you. Maroof HS CPA Professional Corporation is a Toronto based CPA firm focused on in-bound and outbound income tax matters in Canada.