A lot of people have claimed CERB for the full 28 weeks period, totalling up to $14,000. Canada Revenue Agency (CRA) has issued letters to the taxpayers who they think might not have been eligible. The confusion came because the CRA did not mention the word “Net” while explaining the self-employment for CERB purposes.

Self-employment income is always net when reporting on the Income-tax return in Canada. Many CERB receivers are claiming they assumed that it must be Gross. Regardless, whether someone is eligible to get benefits of $14,000 whereas (s)he was making less than $5,000 pre-pandemic is not the question here. The fact is the CERB Act and Income Tax Act are totally different. It does not matter if you are asserting your eligibility for $14,000 (28 weeks) or you are criticizing those getting benefits more than they earned last year.

There is a lot of anxiety amongst those who got benefits based on Gross self-employment income. Many tax advisers have quickly jumped on to advise the clients to adjust 2019 income tax returns.

Should you adjust your 2019 income tax return to remove expenses so that you can meet CERB eligibility?

That might not be a good idea!

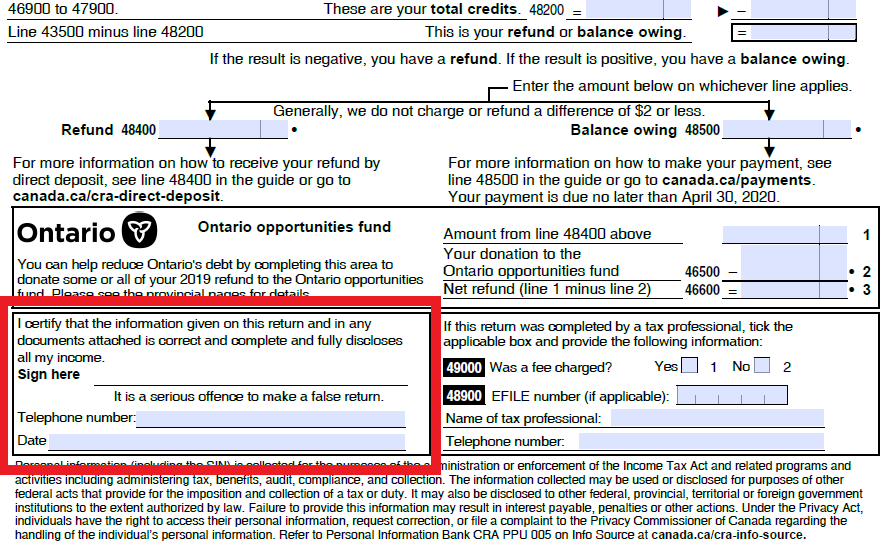

When an individual sign off the individual income tax return (t1), it must not be willfully false or contain any misrepresentation.

By signing T1, the taxpayer certifies that all the information contained in the tax return and documents attached to it is correct and complete. Further, the taxpayer also certifies that it fully discloses all the income. “It is a serious offence to make a false return.”

So if you are planning to adjust your 2019 Income tax return just to meet the eligibility criteria, try not to do it!

This quick fix is not the right fix. When a taxpayer intentionally overstates expenses to reduce income taxes, there are penalties and interest applicable. Depending on the amount, there can be gross negligence penalties involved as well.

And those tax advisers and accountants who are happily advising to adjust such 2019 income tax returns may want to check third-party penalties as well.

Not to mention, when an income tax return is adjusted, this may trigger potential reviews for the years other than 2019.

At the same time, there is no such obligation under the Income Tax Act to claim all the expenses. While adjusting the 2019 income tax return is not recommended, one might need to go easy on expenses for 2020. In order to be eligible for CERB, the taxpayer must have a $5,000 income from the mentioned sources within the last 12 months. If you did not have enough income in 2019, your first two and half months of income of 2020 can make you eligible.

This post is for general information purposes written in response to a lot of inquiries on the subject. Whether you should or should not adjust T1 2019, is totally up to you. Readers are cautioned not to use this post as a tax-advice. Consider discussing the matter with your individual income tax accountant and do raise questions about all the possible implications of such adjustments.

Maroof HS CPA Professional Corporation is a CPA firm in Toronto and Vaughan providing individual income tax services to clients in Canada.

In 2021, you can file your 2020 personal income tax return from the safety of your home. File your income tax return online!