NOTE: the Government is proposing to extend the CEWS further until June 2021.

Canada Emergency Wage Subsidy (CEWS) has undergone major changes in July 2020.

- Extension of CEWS until end of 2020

- Wage subsidy has been split into two parts; Base Subsidy and Top-up Subsidy

- Inclusion of more eligible employees

- CEWS access for Non-Arm’s length employees

- Employers with changes in business structure and organization such as acquisitions, amalgamation, or windup

Extension of Wage Subsidy until Dec 31, 2020

The Canada Emergency Wage Subsidy is now extended until the end of the year. However, changes (new rules) are mostly applicable from the 5th period onwards.

Currently, qualifying periods are as below:

- Mar 15 – Apr 11, 2020

- Apr 12 – May 9, 2020

- May 10 – Jun 6, 2020

- Jun 7 – Jul 4, 2020

- July 5 – Aug 1, 2020

- Aug 2 – Aug 29, 2020

- Aug 30 – Sep 26, 2020

- Sep 27 – Oct 24, 2020

- Oct 25, – Nov 21, 2020

- Nov 22 till the end of the year – Not announced yet

For the purpose of simplification of rules, we have grouped the periods as below:

- Period 1 to Period 4 – Old rules

- Period 5 and Period 6 – Safe harbour rules

- Period 7 to period 9 – New rules

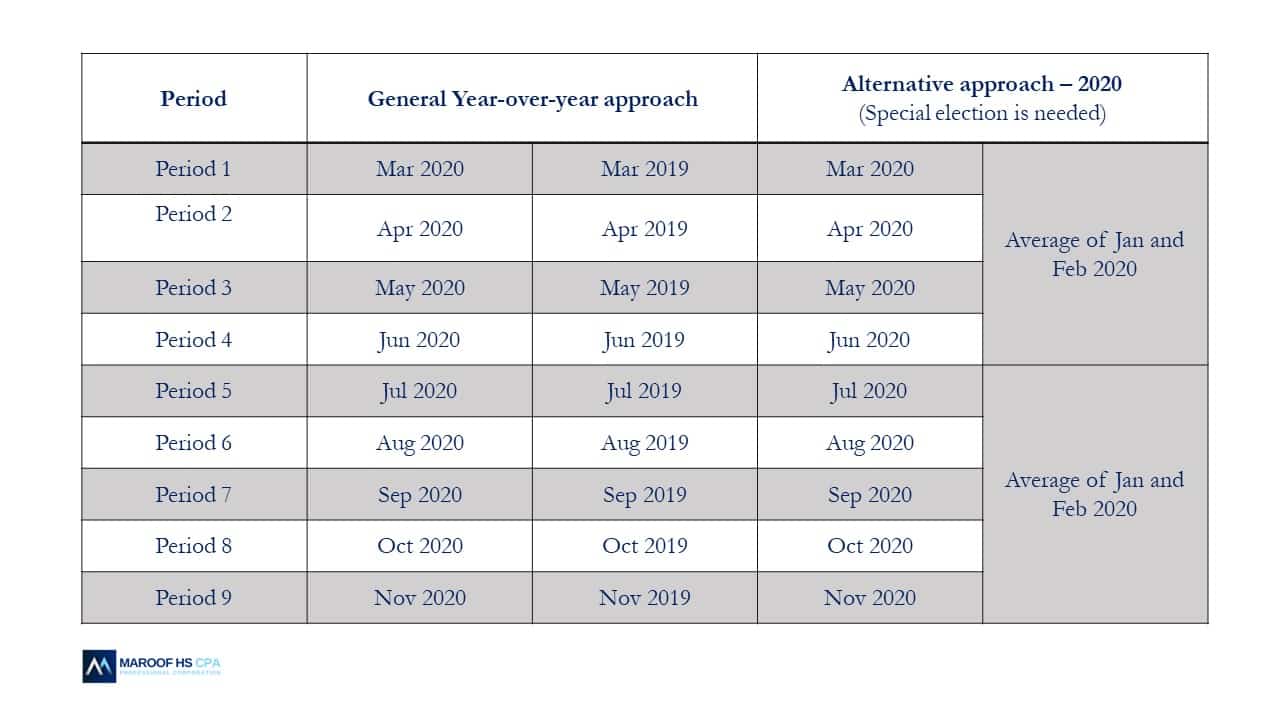

Qualifying Revenue for Canada Emergency Wage Subsidy

There are two approaches to determine the qualifying revenue:

- General approach – year-over-year

- Alternative approach – current year

More Employers and Employees are included

From the 5th period onwards, CEWS will be available to more employers. Any employer who sees a drop in revenue will be eligible for CEWS.

The 14-day rule previously applicable is not applicable from 5th period onwards. Under the new rules, employees do not have to be paid once every 14 days which left many employees ineligible for CEWS. More employees are eligible under new rules.

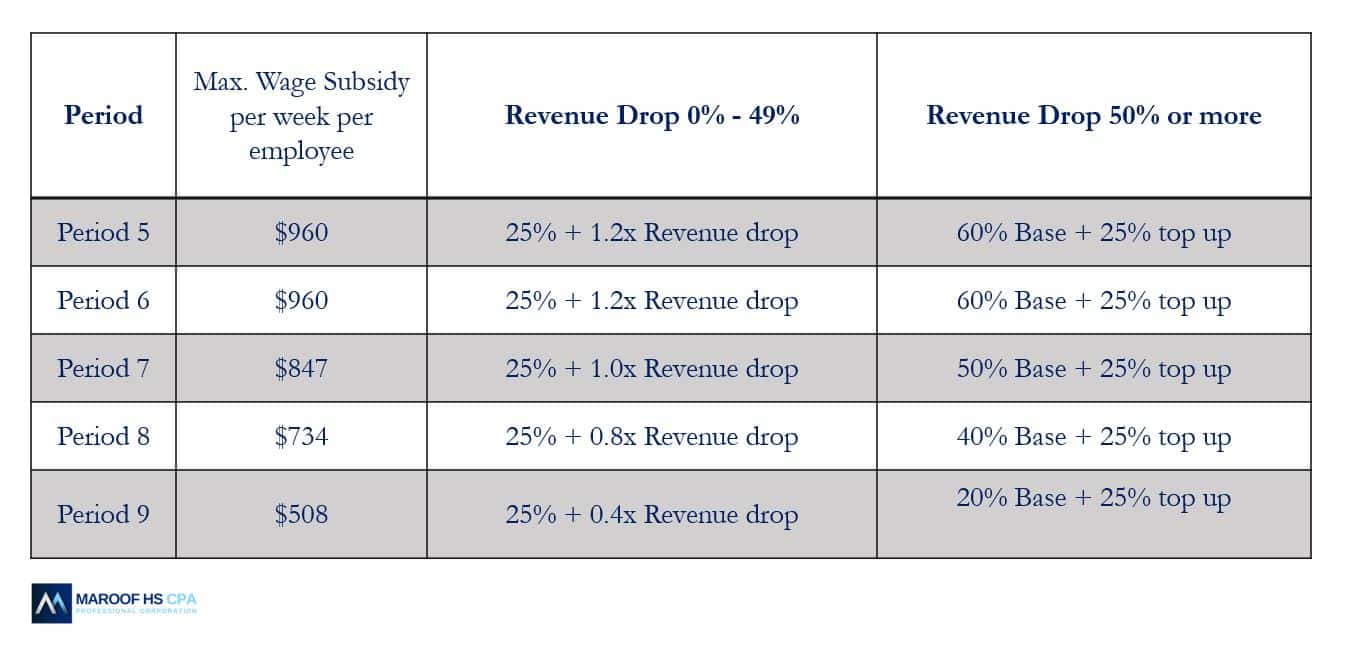

Calculation of Canada Emergency Wage Subsidy

Under the old rules, the wage subsidy per employee was either 75% or $847/week for an eligible employee.

In order to calculate CEWS under new rules, two important parts of the subsidy need to be understood.

- Base Subsidy

- Top-up Subsidy

The total subsidy is equal to base subsidy plus top-up subsidy.

Safe Harbour Rule

Under the new rules, it is possible that the wage subsidy for employers can drop as compared to the one calculated under old rules. Safe harbour rule is introduced to ensure that the employers do not lose subsidy due to new rules. Safe harbour rule is applicable for period 5 and period 6 only.

Under the safe harbour rule, the CEWS per employee is greater of subsidy calculated under old rules or the subsidy calculated under new rules. .

New Deeming Rule

The new deeming rule prevents a sudden drop of subsidy if the revenue drop % in the subsequent period is less than the current period.

CEWS Access for Non-Arm’s Length Employees

Under the original (old rules) CEWS was not available for the employees who do not deal at arm’s length with the employer such as owner-manager and did not receive salary between Jan 01, 2020, and March 15, 2020. New rules are introduced which enable such employees to select a different baseline period which may make them eligible for CEWS.

New Baseline Periods are:

- Baseline period as per original rules: Jan 1 to Mar 15, 2020

- Baseline periods depending on the qualifying periods:

- Period 1 to 3: 03/01/2019 – 05/31/2019

- Period 4: 03/01/2019 – 05/31/2019 OR 03/01/2019 – 06/30/2019

- Period 5 to 9: 07/01/2019 – 12/31/2019

Note: Please mind the year 2019 above.

Read: Canada Emergency Wage Subsidy (old rules)

Are you an eligible employer receiving CEWS? CRA has already started auditing CEWS Claims, learn more here.

Important Notice:

This post is an attempt to simplify the Canada Emergency Wage Subsidy for the readers. Due to the continuously evolving nature of Covid-19 related programs, we advise all the readers to either contact the Canada Revenue Agency or their corporate tax accountants to get up-to-date information.

If you need help with the calculation and application of Canada Emergency Wage Subsidy, please do not hesitate to contact us.