It is not unusual for Canadian businesses to expand into the United States.

U.S. and Canada have two different tax systems and such a decision needs careful planning and consideration.

In this post, we are going to have a quick overview of different structures that can be adopted by Canadian businesses to operate in the United States. This post is meant to be a simplified version for readers and does not discuss many other factors that would be otherwise considered by a professional tax adviser. If you are new to U.S. Taxation, you are recommended to read some technical terms used in this post here.

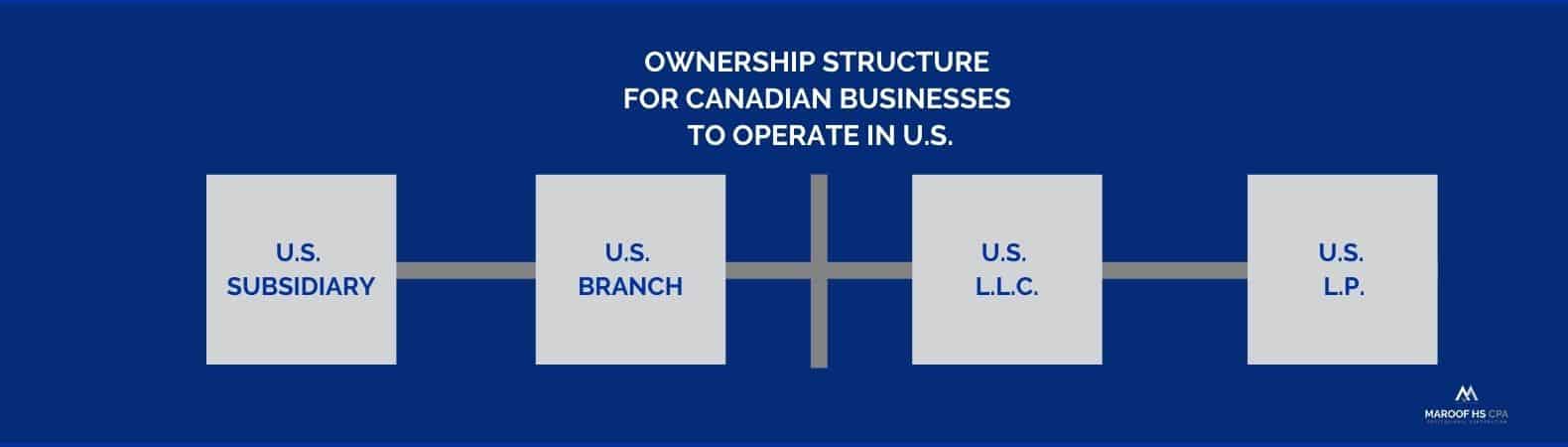

Business structures that Canadian businesses can use to operate a business in the United States

Canadians looking to expand their businesses into the United States can choose from one of the four business structures:

- U.S. Branch of a Canadian Corporation

- U.S. Subsidiary of a Canadian Corporation

- U.S. Limited Liability Corporation (LLC)

- U.S. Limited Partnership (LP)

Before you proceed further, this is recommended to read our post about U.S. Taxation for Canadian Businesses. You should understand the concepts of PE, ECI, FDAP income, and Canada-U.S. Tax Treaty provisions.

(1) U.S. Branch of a Canadian Corporation

One of the options for Canadian Corporations to do business in the United States is to set up a branch there. As a branch, you will be treated as a foreign corporation for U.S. tax purposes. In order to operate a branch of a Canadian corporation, authorization is needed by each state where the branch operates.

U.S. taxes for the Branch of Canadian Corporation

A U.S. branch of a Canadian corporation creates a permanent establishment (PE) in the U.S. ECI of the branch will be taxed at the graduated rates U.S. Corporate tax rate of 21%. There will be a Branch Profits Tax on the after-tax income. The Canada-U.S. tax treaty reduces BPT to 5% only as compared to 30% for non-treaty countries. The first $500,000 will be exempt from BPT as well. Canadian corporations must file 1120-F annually.

Canadian Taxes for the U.S. branch of a Canadian Corporation

Canadian Corporation (CanCo) reports its worldwide income on T2. The worldwide income is taxed in Canada. Foreign tax credits are available to provide relief from double taxation. Losses from the branch can be offset against the other profits of CanCo.

(2) U.S. Subsidiary of a Canadian Corporation

An alternative to the U.S. branch is to establish a subsidiary in the United States. This is a separate legal entity established under the laws of the United States. US tax classification for such an entity is C-Corporation. Canadian corporation is a foreign shareholder of such corporation. CanCo enjoys liability protection since it’s a separate legal entity.

U.S. taxes for U.S. subsidiary of a Canadian Corporation

Since U.S. Subsidiary is a U.S. corporation, it files its own taxes in the U.S. using 1120. Canadian Corporation does not need to file U.S. income tax returns. U.S. corporation pays income tax on its taxable income in the U.S. Any dividend payments from U.S. subsidiary to a Canadian parent are subject to a 5% withholding tax (15% if the shareholders are individual).

Canadian taxes for U.S. subsidiary of a Canadian Corporation

Canadian corporation reports its worldwide income. Foreign tax credits are available against the taxes paid in the U.S. Losses of the U.S. subsidiary corporation cannot be offset against the income of the Canadian Parent. Some of the important tax considerations are as below:

- Canadian Foreign Affiliate Rules and U.S. Transfer Pricing Rules are applicable.

- Canadian dividend tax rules are applicable

- Canadian Controlled Private Corporations lose Qualified Small Business Corporations (QSBC) status and U.S. source income is not eligible for Small Business Deduction.

- Additional Reporting requirements in both U.S. and Canada for foreign assets

Canadian Controlled Private Corporations (CCPC) with U.S. Source Income

Canadian Controlled Private Corporations (CCPC) have preferential tax treatment as per Canadian Tax Laws. The first $500,000 income is subject to a small business deduction which significantly lowers overall corporate income taxes. When a CCPC has U.S. Sourced income some of the key tax considerations should be taken into account:

- A CCPC having U.S. Branch is not eligible to take the small business deduction on income derived through Permanent establishment in the U.S.

- If CCPC has a services PE in the U.S., such income is also not eligible for a small business deduction.

- If a CCPC has U.S. operations, it can affect its eligibility to be a Qualified Small Business Corporation in Canada (QSBC). Shareholders of CCPC will not be able to take advantage of Lifetime Capital Gain Exemption (LCGE) in Canada. LCGE limit as of 2020 is $883,384 in Canada.

Deciding on U.S. Operations is a very critical decision for any Canadian Corporation. Shareholders do not necessarily have to lose the QSBC status of their otherwise eligible CCPC by having a U.S. Subsidiary. It is recommended to set up another Canadian Corporation for this purpose and incorporate a tiered structure using that corporation.

(3) U.S. Limited Liability Company (LLC)

Limited Liability Company (LLC) is an American creation and a structure used in the United States. There is no LLC structure available in Canada. Canadian businesses expanding to the United States are generally not recommended to operate through American LLCs!

U.S. tax treatment

U.S. LLCs are pass-through entities where the income flows to their members (LLC has members, not shareholders). By default, a single-member LLC is considered a sole proprietorship for income tax purposes whereas more than one member LLC is a partnership. Members of LLC do have the choice to elect as a C-Corporation – an option known as “check the box”. Income derived from the U.S. LLC is taxed in the hands of its members.

CRA Tax Treatment of US LLC

CRA does not consider a U.S. LLC a pass-through entity for income tax purposes and considers them as a Corporation. Distributions from a US LLC to Canadian members are considered dividends. The time lag between earnings and distribution of an LLC creates a mismatch in income taxes in both US and Canada. It causes a double taxation problem and Canada’s U.S. Tax treaty doesn’t provide any relief. Therefore, not a smart choice!

Read: How a US LLC is taxed in Canada?

(4) U.S. Limited Partnership (LP)

One of the main reasons U.S. Limited Liability Companies are popular is the protection of liability. Since using LLCs causes a double taxation problem for Canadian members, an alternative is using U.S. Limited Partnership (LP).

U.S. Tax Treatment

Limited Partnerships are taxed on a pass-through basis. Income from U.S. LP is taxed in the hands of its partners and U.S. Income taxes are paid in the U.S.

Canadian Tax Treatment of U.S. Limited Partnerships

Unlike LLCs, Canada Revenue Agency recognizes U.S. LP as a pass-through entity i.e. the income flows to its partners in Canada. U.S. taxes paid on the income in the U.S. provide foreign tax credits in Canada as per the U.S. Canada tax treaty.

U.S. State Taxes for Canadian businesses

The Canada-U.S. tax treaty works at the federal level. Many states follow this tax treaty negotiated at the federal level whereas some do not. At the federal level tax treaty provides relief from taxation on ECI unless the PE threshold is met. States which do not honor federal tax treaty have their own rules to tax ECI if there is some sort of presence in that state.

If a Canadian corporation meets nexus (minimum threshold) it may be subjected to state taxes including state income taxes, franchise taxes or state excise taxes. Nexus varies from state to state. Generally, physical presence is the most common nexus but other forms of nexus are also considered such as Agency nexus, Affiliate nexus, or economic nexus. It’s not only the nexus standard at the state level but there are other nexus standards within each state for different taxations.

States which do not follow Canada’s U.S. tax treaty may cause double taxation for Canadian businesses since foreign tax credits are available under the relief provisions of the treaty only.

If you are a Canadian business and looking to expand to the United States, we can help you with determining the right business structure. We have both U.S. CPA and Canadian CPA available to help you navigate the complex technicalities of U.S. and Canadian taxes.

This post is for information purposes and cannot be considered as advice, hence, the writer or Maroof HS CPA Professional Corporation does not have any liability towards the decisions taken by the readers. Readers must consult a professional tax accountant specializing in U.S.-Canada Cross Border Tax issues.

19 thoughts on “U.S. Canada Cross Border Taxation for Canadian Businesses”

Do I need to file an income tax return for my Canadian corporation if I sell on amazon store in US?

If you sell on a U.S. Amazon store, you need to file a Corporate tax return for Canadian Corporation. If you have an ECI from the U.S. you must file the return regardless of whether you have to pay taxes in the US are not. You need to file 1120F with IRS in U.S. and T2 Corporation income tax return in Canada. Generally, the U.S. Amazon FBA store does have ECI and if you are fulfilling from Canada than not. There might be other factors that can cause a permanent establishment in the U.S., you must look at the full picture.

Hi,

Can I work on corp to corp assignments being a Canada incorporation for US clients, without having any establishment in USA.

Does the canada incoporation need to file taxes with IRS?

Will there be any legal aspects for US client to follow in settling the invoices ?

Thanks in advance,

Maharshi

This is very minimal information to reach a conclusion. You should formally consult a cross border tax accountant.

Hi Maroof,

We are looking to establish a new business with partners who live in both Canada and the US and are trying to determine the optimal tax structure. The Canadian partner has a green card but primary residence is in Canada. US partners are permanent residents in the United States (green card holders).

We intend to sell custom jewelry with United States based customers as our primary target. Operations will be set up in Canada with products shipped direct to US customers.

Hoping you might be able to provide some guidance on how to structure the business.

hi Justin, there are many things that should be considered here. Well, generic guidance is difficult to provide in this comment, you should seek proper tax advice from someone in this connection. A Canadian resident with U.S. green card may also have unforeseen issues such as Capital gains whereas US persons may have to take into consideration factors such as GILTI or other reporting requirements as well.

You mention US LLC (owned by Canadian member resident) structure is not recommended and leads to double taxation problem in Canada. Does your conclusion apply to both situations:

a) If the US LLC is ETBUS having ECI and is transparent in the US (and thus Canada taxes the single member as dividend income tax)

b) if the US LLC has elected to be taxes as Corporation with IRS (and thus Canada taxes the income because not eligible for tax reduction)

Are both of the situations leading to double taxation or is the Scenario B only causing double taxation.

I would like to clarify the Scenarios A and B in the question above:

.. a) it is NOT a PE

.. b) it IS a PE

hi James

From a Canadian tax perspective, LLC whether fiscally transparent or checked the box, both are treated as corporations! If it is treated as a US Corp, that helps with double taxation in terms of foreign tax credits. If fiscally transparent, no FTC but a deduction might be available. You should check this post for more clarification.

Can a Canadian tax resident be a member of a US LLC through a US LP and avoid adverse tax consequences? In other words, can a Canadian tax resident be a limited partner in a limited partnership, and then the limited partnership is the member of the US LLC that owns the asset? Would that get pass through tax treatment from the CRA?

Canadian limited partner in a U.S. LP is generally a passive activity for U.S. tax purposes.

A U.S. LP is considered a partnership by CRA. However, LLP and LLLP are considered corporations (there are conversion rules for them).

For the structure you are contemplating, you should seek proper tax advice. If the partnership is owning the shares of the corporation (LLC), there will be again a mismatch issue with respect to earnings vs distributions. Also, the kind of assets you need to own can create other reporting issues too.

Hi Maroof, I am a Canadian and planning to sell on Amazon US. I already have a registered Ontario Corp. I am advised to setup a US corporation which would be used to open US Bank account and purchases only in US. This entity would sell to Canadian Entity for onward sale on Amazon US. Botj entities would have two owners in it. My questions;

i) What would be most tax efficient structure in this case. Does a US corporation as subsidiary of Canadian corporation advisable?

ii) Can i use transfer pricing from US entity to Canadian entity at same price (the price at which US entity would be purchasing from market/3rd parties).

Regards,

hi Huzaifa

An Ontario corp can also sell on a U.S. Amazon store. If you are setting up a U.S. Corp, of course, there will be transfer pricing rules applicable for transactions between them.

For setting up an entity, you should seek both legal and tax advice.

Can I have a US LLC as the general manager on my US LP? My assets would all be under the LP, though. I am trying to figure out the best way to avoid the double taxation that LLCs have on us Canadians, which is an LP, but the LP doesn’t have any liability protection like the LLC does.

Hey Nathan,

I am in the same boat here. If you’re up for it, we should connect via email sometime to discuss possible a work-around.

Best,

Brendan

Hi Maroof,

Can I call you with a question regard to Taxes,

How American Corp. can pay to Canadian Corp. a Commission without holding any taxes.

Thanks,

Essa

Hi Essa

Of course, you can always call us. However, we avoid providing casual consultations or quick answers on the phone.

You can always request an appointment using the below link:

https://www.maroofhs.com/contact/

Thanks

Hi Mahroof, my question is around structure and tax filing. I have setup a new Canadian Corp that will 100% invest in a US-C Corp that I plan to open as well in the state of Pennsylvania to purchase rental properties in that state. Now I understand I need to do a foreign company corporate Tax return in the US. Now I don’t plan to pay any dividends right now to bring the money back to Canada. Now if I don’t plan to do that, would I still need to file a return in Canada? If I need to then what do I report? Also when I fund the Canadian Corp is that considered an investment? Or capital? And then when the Canada Corp invests in the US-C would that be a capital investment? Happy to jump on a call

Hello Javed, thanks for your comment. Due to risk management issues, we can not provide any comment on the situation mentioned by you as it is very specific to you and borders tax advice. You are welcome to request a formal consultation (paid consultation) by dropping an email to Canada@Maroofhs.com. If there is a corporation, in Canada or U.S., you are required to file tax returns for those regardless of distributions or activity. Not only tax returns, but also other information returns if needed. There is an indication that you might have to file form 5472 in the U.S. amongst others. These forms carry substantial penalties, hence, we always recommend seeking a formal consultation to determine reporting requirements.